|

A.

Market Overview

The UAE equity

markets are a fairly recent development. Until 2000,

stocks were traded over an un-regulated over-the-counter

market. In May and November 2000, the Dubai Financial

Market (DFM) and

Abu Dhabi Securities Market (ADSM) began trading.

Existing over-the counter stocks were gradually

transitioned to the formal exchanges. Stock market

performance has been nothing short of spectacular and

value traded has increased substantially.

B.

History of IPOs

The first IPO on

an organized exchange, Dubai Islamic Insurance and

Re-Insurance ("Aman"), occurred in October 2002. Since

that time, the pace and size of IPOs has increased

substantially and is expected to increase further as can

be seen from Figure 3, despite recent measures taken by

the authorities to slow the flow of new companies coming

to market. The amount to be raised at IPO in 2H2005 that

has been publicly disclosed amounts to 2% respectively

of the existing combined estimated free float market

capitalization of the DFM and ADSM.

As the stock

market has risen and IPOs have performed, so the level

of interest on the part ofretail investors has increased

substantially. This behavior is typical of a bull market

environment.

As issues have

become progressively more over-subscribed, so investors

have borrowed to improve their allocation of shares. As

more investors have borrowed, so the level of

oversubscription has risen, forcing investors into a

vicious circle of borrowing even more so as to obtain a

decent absolute allocation.

Three benchmark

IPOs have been Addar, Agthia and Aabar. After the Addar

IPO, which saw oversubscription of 450x, the UAE

authorities imposed limits on the maximum permissible

leverage accorded to investors. Agthia, which came after

Addar, was the first IPO to guarantee a minimum

allocation to retail investors. As a result, the number

of subscribers rose significantly and oversubscription

declined significantly. Aabar was important because the

return to high levels of oversubscription led the

authorities to impose quantitative limits (i.e. a

maximum AED amount to be lent per bank) on margin

lending at banks.

C.

Cost of Entry into IPOs

The need to

borrow so as to obtain a reasonable allocation at IPO

imposes a high cost on investors, especially given that

only a very small fraction of the amount being

subscribed to is likely to be allocated. We have

estimated this cost for each of the IPOs that has been

carried out to date.

i) Our

assumptions are as follows: i) An equity capital amount

of AED100,000. It is important to specify this as later

offerings guaranteed a minimum allocation to retail

investors.

ii) Cost of bank

funding of 5.5% per annum and a loan arrangement fee of

1.0%. Here it is important to bear in mind that as there

is more than one bank at which investors can subscribe

to shares and borrow and competition between banks has

meant that interest rates have tended to decline with

loan size in later IPOs.

iii) An

opportunity cost for the equity portion of approximately

1.5% reflecting the interest foregone on a time deposit.

iv) Subscription

at the end of the subscription period rather than at the

beginning, thereby minimizing both the opportunity cost

and the interest due on any loan.

We calculate the

estimated cost as a percentage of the value of the

eventual allocation given the above assumptions.

D.

Returns on IPOs

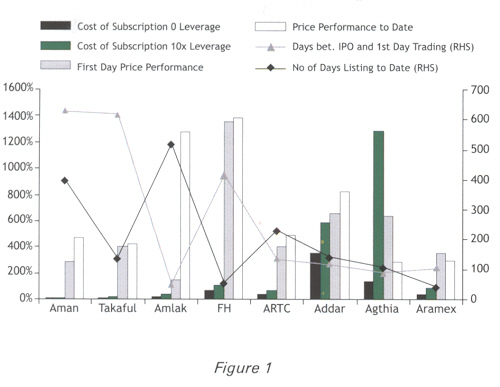

While the cost

of entry is high, this has been more than compensated in

almost all cases by the performance of the stocks from

the first day of issue onwards, as is illustrated in

Figure 1.

While

subscribers to the earlier IPOs had to wait almost two

years from the end of the subscription period to

listing, subscribers to the four most recent IPOs have

had to wait between 91 and 134 days between the close of

the IPO and the listing of their shares. An active grey

market has provided liquidity in the interim.

E.

Valuation of companies coming to IPO

Companies

issuing their shares on the exchange have to comply with

regulations of the Emirates Securities and Commodities

Authority (ESCA). There are currently two ways for the

shareholders of an existing company ("Old Co") to bring

it to market:

i) They can

establish a new Public Joint Stock Company (PJSC or "New

Co"). New Co can then acquire the assets of Old Co prior

to the IPO with New Co stock as consideration. A

valuation committee is appointed by the Ministry of

Economics and Planning to compare the valuation of the

company and goodwill relative to Book Value

historically. The "un-written" rule is that valuation

should not exceed 1.5x book value.

ii) They can

establish a New Co. that would acquire the LLC for cash

post-IPO. The ministry requires a report to validate the

valuation of "Old Co" at acquisition. There is no

regulation/restriction regarding valuation under this

structure.

Furthermore,

under the current regulations, the shares in the New Co

must be offered to investors at par, and a minimum of

55% of paid in capital should be offered at the IPO.

However, according to the new law which is expected to

be implemented at some point in 2H2005, companies will

no longer be obliged i) to offer a minimum of 55% of

paid-in capital at IPO or ii) to create a new company

for the purpose of listing.

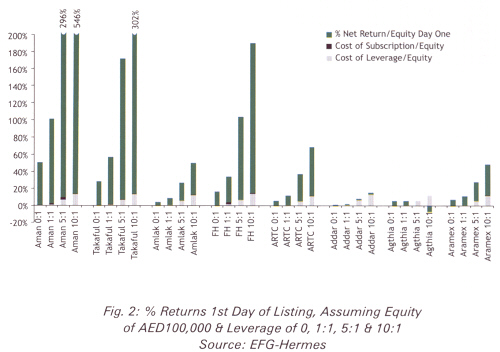

Part of the

reason that there has been such intense interest in IPOs

is that they have been priced, on the whole, at

valuations that are markedly below the prevailing market

valuations, as is illustrated in Figure 8. Furthermore,

there seems to have been a difference between the

valuations of private sector companies and public sector

companies being brought to market, with public companies

being offered at lower multiples. Lower than market

valuations for IPOs have helped to fuel jumps in share

prices on the first day of trading and sustain them

thereafter, as was illustrated in Figure 2.

F.

Sensitivity of IPO Returns

In this section,

we examine the sensitivity of IPO returns to leverage

employed by investors. We find that there have been

increasing returns to utilizing higher levels of

leverage, especially before the Agthia offering, when

offerings did not provide a minimum allocation to retail

investors. Minimum allocations to retail investors have

reduced the proportionate allocation to investors

subscribing to more than the minimum amount.

G.

Inefficiencies of the Current System

As we discussed

earlier, the fact that a UAE company has to list at a “

reasonable” valuation has led to tremendous demand and

oversubscription. The pro-ration of subscriptions has

led to an incentive to over-subscribe and with the banks

being more than willing to lend, a competitive dynamic

among investors has led to increasing and ultimately

massive levels of loanfinanced oversubscription. As a

result, a portion of the discount to market value has

gone to the banks as arrangement fees, interest and zero

cost deposits (although, as a result of competition,

banks have started to pay interest). The impact has been

significant on banks' financial performance with a

tremendous rise in non-interest income.

Ultimately, the

current IPO system is inefficient with companies unable

to price their shares in line with the market and

investors having to pay high transaction costs so as to

obtain a reasonable allocation. The authorities are in

the process of tackling both inefficiencies, first by

not imposing onerous terms on issuers and second by

imposing limits on leverage provided by banks so as to

reduce subscription costs for investors.

|